In this comprehensive review and ratings, we provide an in-depth analysis of AssetsFX, a Forex broker, including its features, trading platform, customer support, and more. If you’re looking for detailed information before choosing a Forex broker, this review will help you make an informed decision.

Evaluating AssetsFX

In order to be well-informed about the services and trading conditions of AssetsFX, a group of STP brokers claiming to provide low commissions, ultra-low spreads, and fast execution, FXNDB review of this trading provider endeavors to provide a thorough understanding. We have scrupulously examined all of their offerings and have compiled all of the essential facts and pertinent information in this review. By reading it, you will attain a comprehensive comprehension of AssetsFX.

Introduction to AssetsFX

This company provides a brief insight into the services they offer.

It is widely understood that trading with unregulated brokers carries a large degree of danger, making it hard to find investors who are willing to invest in them. The same is true for AssetsFX, which, although owned and managed by Oy Nettico Ltd, based in Espoo, Finland, is not regulated, and thus, might be susceptible to scams. Therefore, we cannot recommend using this broker.

Ensuring the Protection and Safety of AssetsFX

It is a major warning sign that AssetsFX is not regulated and has no licensure. We would advise against trading with brokers who are not regulated, and AssetsFX is no different. With no regulations, we cannot guarantee that this broker is utilizing segregated accounts or other means of keeping customer funds secure.

Charges and Margins of AssetsFX

Read a comprehensive review and ratings of AssetsFX, a popular forex broker. Gain insights into their services, trading platforms, customer support, and more to make an informed decision about your forex trading needs.

The fees and spreads associated with AssetsFX can be inspected. These charges and margins are a key element of the service the company provides.

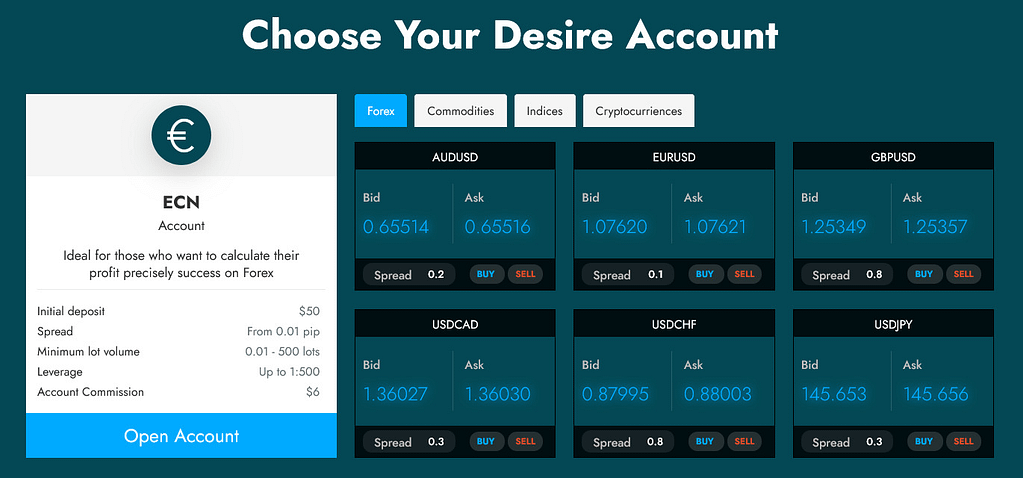

The 2.2 pips spread offered on cent accounts and the 1 pip spread on standard accounts is quite large. However, the spread is still sufficient for day traders and swing traders. Brokers also provide the option of a 0 spread account which is excellent for scalpers. This account has a commission of 6 USD and 4 USD (round turn) per lot that is traded. All in all, AssetsFX‘s spreads and commissions are in line with the industry average.

Accounts, Deposits, and Withdrawals of AssetsFX

AssetsFX provides four account options for diverse traders and budgets, which all have minimal deposits of 1 USD. The Cent account has a spread of 2.2 pips, no commission, leverage of up to 1:500, and instantaneous order executions. The Standard account has a minimum deposit of 10 USD, 1 pip spread, and a leverage of up to 1:500. The ECN account has no pip spread, a minimum deposit of 50 USD, a commission of 6 USD per turn, and a leverage of 1:500. The ECN Pro account is designed for traders with a capital of 1000 USD and more, and comes with a spread of 0 pips, a commission of 4 USD per turn, and a leverage of 1:500.

A depiction of an assortment of trading accounts can be seen in the image above. These accounts vary depending on a trader’s needs and goals.

AssetsFX Making Money Transfers: Adding and Removing Funds

AssetsFX, When beginning a relationship with AssetsFX, the lowest amount of money that must be deposited is $1, which is generally in line with other companies. Traders can fund their account with either wire transfers or cryptos.

VISA and MasterCard are not supported, nor are Neteller and Skrill. This is a concern as the only payment methods accepted by this company are cryptocurrency and bank wire transfers.

AssetsFX Trading: A Look at the Items and Characteristics

It appears to be strange that USD to Chinese Yuan is amongst the 31 Forex pairs given that the Chinese currency is known to be fixed and not floating. Therefore, speculation regarding its changes is not possible since the central banks determine the exchange rates. In theory, the other 30 pairs would be enough for trading. However, due to the fact that the broker is unregulated and crypto is the only accepted form of payment, we do not suggest trading with them. As for other asset types, there are only seven commodities of metals and oil available. It is interesting to notice that the broker accepts cryptos for payments but does not provide them for trading. Another potential warning sign.

Learning the Basics of AssetsFX Trading

Getting Started with Trading through AssetsFX

If you are still planning to invest with this broker, you must register and establish an account. Traders are presented with the possibility of a demo account, which can be beneficial in some situations, as well as a range of live accounts.

AssetsFX Platforms for Trading offered

Although there are some trustworthy and legitimate brokers in the Forex market, it is advisable to remain careful when dealing with AssetsFX. This broker provides two leading platforms, MetaTrader 4 and MetaTrader 5, which are highly advanced and customizable. These platforms include the standard features such as Expert Advisors, trading signals, and the auto-trading solution of “Myfxbook”.

Perks and incentives

Rewards and bonuses can be great motivators for employees, and employers can use them to encourage and recognize hard work. These incentives can come in a variety of forms, such as monetary awards, additional time off, or recognition in front of colleagues. Perks and incentives can be an effective way for employers to boost employee morale and productivity.

The Forex market is known for its generous gifts and promotions, and AssetsFX is no exception. They have several bonuses to attract traders, such as deposit bonuses, instant cash back, and NFP bonuses that can give traders a boost in their trading.

A picture of bonuses is displayed, depicting a graphical representation of rewards.

Providing assistance to customers

The delivery of a customer support service is of great importance to any business. It allows customers to get the help and answers they need to resolve any issues they have with the product or service. Customers can contact the company’s customer service representatives in a variety of ways, including by phone, email, or online chat. The customer service team is well-trained and knowledgeable and can provide the customer with the necessary information and assistance. Companies that offer great customer support are more likely to gain customer loyalty and satisfaction.

The customer service of assetsfx is available to help.

AssetsFX Forex Broker’s website is only available in English, which is a major limitation in terms of its global reach. Furthermore, there is a lack of localized support centers, and customers can only contact the company via phone or contact form on the site. A live chat option has been added, though. This lack of resources is a major drawback, and we believe customers will experience many difficulties and dissatisfactions if they register with this broker. There is a positive, though – support is provided 24/7. However, the lack of regulations and languages impedes international traders from getting the support they need.

FX Assets Instruction

No educational materials or market research tools are provided. A free VPS service is available as a promotion, but it is insufficient. Without appropriate educational materials and tools, traders will find it hard to manage every trading-related task from a single platform.

Is AssetsFX worth considering?

After perusing our entire evaluation of AssetsFX Forex broker, it was evident that a great many things were not up to our standards, and for this reason, we strongly advise our readers to look elsewhere for a dependable and reputable trading provider. We all aspire to have our funds invested in a secure and safeguarded atmosphere, and unregulated Forex brokers are certainly not something that inspires trust. A lack of authorization, payment options, and trading assets all add up to our pessimistic evaluation of AssetsFX. If the broker obtains a legitimate license and includes trustworthy payment methods, then we could suggest it.

Can one have faith that AssetsFX is a trustworthy and officially sanctioned broker?

What methods are available to deposit and withdraw funds through AssetsFX?

Get a comprehensive review and ratings of AssetsFX, a leading forex broker. Learn about their services, trading platforms, customer support, and more to make an informed decision before choosing them as your forex broker.