GFunded Prop Firm Reviews, Rules That Matter Most

Prop firm reviews can be frustrating because they don’t agree. One trader reports a smooth withdrawal, another says the payout got “reviewed”, and someone else loses an account over a rule they didn’t notice. That gap usually isn’t random, it comes down to rule details and how strictly they’re enforced, especially around drawdown and withdrawals.

This guide focuses on GFunded prop firm reviews covering rules in a way that’s easy to verify. In 2026, most prop firms aren’t regulated like brokers, so trust doesn’t come from a badge on a website. It comes from clear terms, consistent enforcement, and whether payouts hold up when you request them (not just when someone posts a screenshot).

You’ll see the core rules traders mention most often, including the common 10% profit target on evaluations, tight loss limits (often around a 4% daily loss cap and a 6% max loss), and the appeal of no hard time limit. We’ll also talk about the fine print that still applies, like activity rules (often needing at least one trade within a set period, such as 30 days) and how equity and drawdown math can trip people up.

Finally, we’ll cover the mistakes that trigger breaches and payout checks, including oversizing, misunderstanding trailing versus static drawdown, and changing behavior right before a withdrawal. The goal is simple, help you read reviews with context, then decide if the rules fit how you actually trade.

Start here, what GFunded is, and what you are actually buying

GFunded is commonly described as a retail prop firm that’s been operating since 2021. The simplest way to think about it is this: you’re not opening a normal brokerage account and depositing your own capital. You’re paying a one-time fee to access a rule-based trading program (often on a simulated account) that can still lead to real payouts if you meet the firm’s requirements.

That detail explains why reviews are so mixed. Some traders talk about smooth withdrawals, others get stuck in a rule breach or a payout review. In most cases, they bought the same kind of product: a set of rules, a dashboard that tracks those rules, and the firm’s decision process when you request money out.

It also helps to separate three things people often blur together:

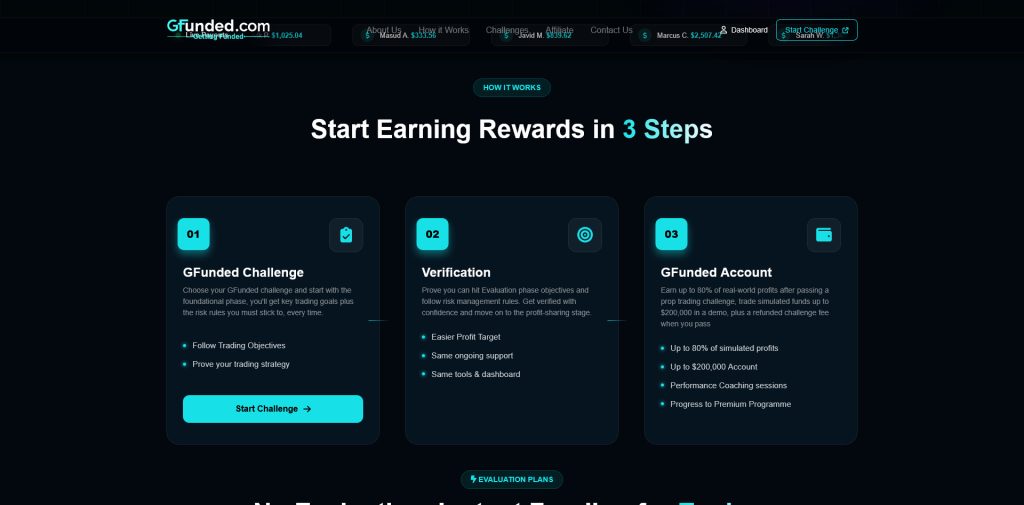

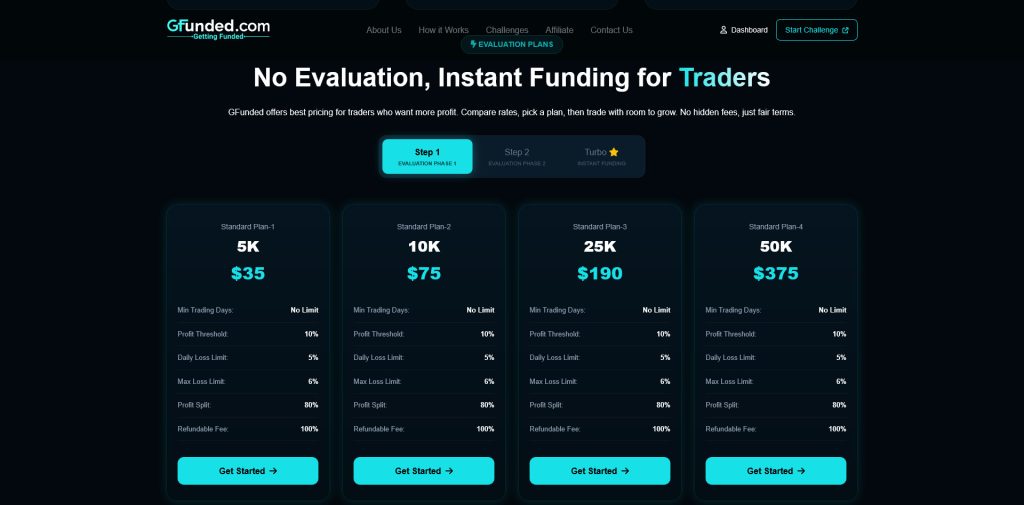

- Evaluation (challenge): you’re trying to hit a profit target while staying inside loss limits.

- Funded stage: you’ve passed the evaluation and can request payouts under the payout rules.

- Instant Funding: you skip the profit-target test and start in a “funded-style” setup right away, usually with different constraints and a higher fee.

Even though many accounts are simulated, your platform, spreads, and execution still matter. A strategy that works on tight spreads can fall apart if costs are wider than expected, or if fills get messy during fast moves.

Evaluation vs Instant Funding, which one changes the rules the most

The big difference is the kind of pressure you feel while trading.

With an evaluation, the pressure is obvious: you’re chasing a profit target (many traders mention 10% on common setups) while living under tight risk limits (often cited around a 4% daily loss cap and 6% max loss, depending on the plan). That combination pushes people into mistakes like oversizing, revenge trading, or trying to “finish the challenge” in one session.

Evaluations can also feel simpler mentally because the goal is clear: hit the target, don’t break the rules, pass. Many GFunded plans are discussed as having no strict time limit, but that doesn’t mean you can ignore the calendar. Activity rules can still apply (for example, needing at least one trade in a set period).

With Instant Funding, the pressure shifts. You usually pay more upfront, but you remove the profit-target finish line. That sounds relaxing, until you realize instant models can feel less forgiving in other ways. Traders often describe instant plans as having tighter drawdown mechanics in practice, plus earlier focus on payout eligibility and “trading behavior” reviews.

A clean way to compare them is like this:

- Evaluation: You’re taking a driving test. You can’t crash (drawdown), and you must reach the destination (profit target).

- Instant Funding: You get the keys now, but there are stricter house rules, and your first “inspection” (withdrawal review) can come sooner.

One more detail that trips people up: permissions can change by plan. Things like news trading, holding over weekends, or using EAs may be allowed on one program and restricted on another, or they may require an add-on. Don’t trust a review that doesn’t name the exact plan and date; read the terms for the product in your checkout.

Before you pay, confirm you are eligible in your country

Country access can be restricted, and those restrictions can change. In 2026, the US and Canada are often reported as blocked in summaries and trader discussions, even when older pages suggest broader access.

Keep it simple and do this before you spend anything:

- Log into the client area (or start the sign-up flow) and check eligibility prompts.

- Read the current terms tied to the exact plan you’re buying.

- Ignore old reviews and comment threads for eligibility, they go stale fast.

If you can’t confirm access in the dashboard and terms, don’t assume you’re eligible.

The core rules traders talk about most, and how they really work

Most GFunded rule problems don’t come from “bad trades.” They come from risk math that doesn’t match the account’s limits. In reviews, you keep seeing the same three numbers: a 10% profit target on many evaluation plans, a daily loss limit often around 4% to 6%, and a max loss that’s often discussed around 6% (some plans differ). The twist is that the details matter more than the headline numbers, especially equity vs balance, and whether max loss is trailing or static.

Use this section as a mental model, then confirm the exact wording inside your plan’s rules and dashboard. Small differences can change everything.

Daily loss limit, why one bad trade can end your day

The daily loss limit is the line you can’t cross in a single trading day. If the rule says 4% daily loss, it means once your loss hits that amount (based on whatever the firm tracks, often equity), the account fails for that attempt.

Here’s the simple $100,000 example traders use because it makes the point fast:

- Daily loss limit (4%): $100,000 x 0.04 = $4,000

- If you’re down $4,000 on the day, you’re typically done.

Now look at what happens when your normal sizing is too big for prop rules. If you risk 2% per trade like you might on a personal account, that’s $2,000 risk per trade.

- Loss #1: -$2,000 (you just used half your day)

- Loss #2: -$2,000 (you hit -$4,000, daily breach)

Nothing weird happened. Two planned losses ended the day.

This is also where leverage tricks people. High leverage doesn’t force you to risk more, but it makes it easy to do it by accident. A position that’s slightly oversized can swing your equity hard during normal pullbacks, spreads widening, or fast candles. It’s like driving a car with a sensitive accelerator, the car isn’t “bad,” but small mistakes get expensive fast.

A practical sizing rule of thumb (not financial advice): try to size so that a normal stop loss on one trade can’t blow the daily limit. Many traders keep the “one-trade damage” small enough that it would take several losses to hit the cap. That gives you room for normal variance, and it reduces the urge to panic trade when you start the day red.

Also watch equity vs balance. If the daily limit is equity-based, open drawdown counts even if you haven’t closed the trade yet. That’s why a trade can be “fine” on your chart but still breach your account during a wick.

Max loss and drawdown type, trailing vs static changes everything

Max loss (overall drawdown) is the total amount you can lose on the account before it fails. Unlike the daily limit, this one follows you across days. If the plan says 6% max loss on a $100,000 account, the basic idea is:

- Max loss (6%): $100,000 x 0.06 = $6,000

- If your account drops to the breach level, it’s usually a hard fail.

The part that changes the feel of the account is how that max loss is calculated.

Static drawdown stays tied to a fixed reference point, often the starting balance.

Trailing drawdown can move up as your account reaches new equity highs.

A quick step-by-step shows why this matters:

- You start at $100,000 with a 6% max loss.

- If it’s static, your breach line stays near $94,000, even after you profit.

- If it’s trailing, and you grow the account to $106,000, the drawdown “floor” may rise as you make new highs (the exact method varies by plan).

- After that, a normal pullback that gives back profit can get you much closer to a breach than you expect.

This is why trailing drawdown can feel tight once you’re doing well. You see green on the account, but the system is also moving the risk line upward, which reduces the room for a normal retrace.

One more thing to confirm before you trade: does max loss change after payouts? Across prop firms, a common pain point is a “rebase” effect, where the post-withdrawal balance becomes the new reference point for drawdown math, or the buffer feels smaller in practice after a payout. It’s not always explained clearly in reviews, so it’s worth checking the payout clause and asking support for the exact definition.

Bottom line: don’t assume max loss is “6% from start forever.” Find out if it’s static or trailing, and whether it’s based on equity or balance.

No time limit does not mean no rules, activity and minimum days still matter

A lot of GFunded plans get described as having no time limit, which sounds like you can trade whenever you feel like it. In reality, two calendar-style rules still trip people up: activity requirements and minimum trading days.

First, the activity rule. Many prop programs include something like: place at least one trade within 30 days (or the account can be closed for inactivity). Traders don’t think about it until life gets busy. Then they log in weeks later and realize the account is no longer in good standing.

Second, minimum trading days. Many plans require results across 1 to 4 trading days (the exact number depends on the program). The goal is simple: stop people from passing in one lucky trade. The most common fail pattern here is emotional, not technical. A trader gets close to the profit target (often 10% on evaluations), then tries to finish it in a single day by sizing up.

If you want a practical approach, treat “no time limit” as permission to go slower, not permission to stop paying attention. Keep a simple routine:

- Place at least one planned trade well before the inactivity window.

- Aim to spread performance across days, even if you hit a big winner early.

- If you’re up big, reduce size and protect the account. If you’re down, don’t try to “win it back” in one session.

Prop rules reward boring habits. The traders who last are usually the ones who respect the limits more than the profit target.

Style rules that make or break accounts, what looks “allowed” vs what gets flagged

In a lot of GFunded reviews, you’ll see the same style claims repeated: scalping is allowed, EAs are allowed, weekend holding is allowed, and news trading is sometimes allowed (often depending on the plan). That sounds wide open, and in many cases it is. The catch is that prop firms usually judge you less by your strategy label and more by your behavior.

Think of it like a gym membership. You can use most equipment, but if you start throwing weights, hogging machines, or doing something unsafe, staff steps in. With prop rules, the “unsafe” stuff is anything that looks like system-gaming, execution abuse, or coordinated behavior across accounts.

If you want fewer surprises, keep your trading easy to explain. Use steady sizing, normal order flow, and avoid last-minute hero trades right before passing or requesting a payout.

News trading, what to check so you do not lose profits after the fact

News trading is one of the biggest gaps between “allowed” and “allowed without consequences.” On some GFunded plan types, traders report news trading is fine. On others (often evaluations), there may be blackout windows around major releases. Those windows can be short, but they matter.

The complaint pattern in prop trading is consistent: a trader takes a winning trade during a restricted window, then later finds out the firm removed the profit, or marked it for review. The worst version is when profits get excluded but losses still count, which can change your results without changing your win rate.

Before you trade any high-impact event, confirm these details in writing (FAQ, terms, or your dashboard rules):

- Which plan you’re on: Instant-style plans and evaluation plans can treat news differently.

- The exact blackout window: It might be “X minutes before and after,” and it might list only certain releases.

- What happens if you trade it anyway: Is it a hard breach, a profit removal, or a review flag?

- Time zone and server time: A “10-minute window” is useless if you’re looking at the wrong clock.

A simple habit helps here: save a screenshot or PDF of the written rule the day you start the account. Then write down the time zone you’re using for news (platform time, New York time, UTC). If you ever need to explain a trade, you’re not guessing.

Scalping and EAs, when fast trading turns into a “restricted tactic”

Scalping and EAs can be fine when they look like normal trading. Where people get flagged is when “fast” turns into execution abuse. In other words, it’s not the 2-minute trade that’s the problem, it’s the pattern that looks like you’re trying to exploit how the platform fills orders.

Across prop firms (including the kind of restrictions traders discuss in GFunded reviews), the common restricted buckets look like this:

- Latency or reverse-arbitrage tactics: Trading to profit from feed delays or pricing mismatches.

- HFT-like order spam: Rapid bursts of orders and cancels that don’t resemble human execution.

- Ultra-short hold times: Some firms in the industry restrict very short holds (often under 30 seconds) because the edge can rely on micro-moves and fills.

If you scalp or run an EA, the goal is to keep your activity looking “plain.” A few practical guardrails:

- Test execution first on small size, especially around session opens and major news.

- Keep hold times reasonable for your style, and avoid lots of sub-30-second exits if your rules warn against it.

- Avoid weird bursts of order activity, like rapid-fire entries, cancels, then re-entries within seconds.

- Keep settings stable on your EA. Sudden changes can look like you’re trying to force a pass.

Normal scalping is like quick footwork. Restricted tactics look more like trying to win on a technicality.

Hedging and multi account behavior, why reviews mention bans

Hedging is another area where the word can mean two different things. Hedging inside one account can be a strategy choice. Cross-account hedging is usually treated as rule circumvention because it can hide risk and “manufacture” a pass.

Prop firms often ban coordinated behavior because the evaluation is meant to measure each account on its own. If two accounts are linked by design, the risk team may see it as gaming, even if each trade looks reasonable by itself.

Examples that can trigger flags include:

- Mirrored trades across accounts: Same symbol, same direction, same time, same size (or proportional size).

- Offsetting positions: One account goes long while another goes short on the same instrument to neutralize risk.

- Coordinated copy behavior: Multiple accounts following the same signals in a way that looks synced.

The safest approach is simple: keep each account independent. Don’t hedge one account with another, don’t mirror entries and exits, and don’t treat multiple accounts like a combined portfolio. If you need to run different systems, separate them by time, instrument, and intent, and keep clean records so your trading story stays believable.

Rules around payouts, why reviews change after the first withdrawal

The first payout is where a lot of GFunded reviews split. Some traders say they got paid in about 2 business days. Others say the same request triggered extra questions, a delay, or even a flag. That doesn’t always mean something shady happened. It usually means the withdrawal process has more checks than most people expect, and those checks get stricter once money is involved.

If you treat payouts like a normal broker withdrawal, you’ll get frustrated. A prop payout is closer to an audit. The “product” is the rule set, and the payout is the moment they verify you followed it.

What happens after you click request, the normal payout review flow

After you request a payout in the dashboard, the process is usually a sequence of reviews. Think of it like airport security, you can fly, but you still go through screening every time.

In plain language, here’s what typically happens:

- You submit the request in the dashboard and pick a payout method (many traders report crypto options like USDT, and some mention third-party providers depending on region).

- Rule compliance check comes first. They verify you stayed inside the big lines, like daily loss and max loss (and whether the limits are equity-based or balance-based on your plan).

- Trade behavior check comes next. This is where firms look for patterns that look like system-gaming, like sudden lot-size spikes, last-minute “hail Mary” trades, or execution tactics that resemble latency-style abuse.

- KYC and account verification often becomes the bottleneck. Even if you traded perfectly, missing documents, mismatched names, or delays in verification can push your payout back.

- Internal holding step may apply. Some traders describe this as a Profit Locker-style stage, where profits move into an internal bucket before they’re released. It feels like an extra hoop, but it’s also a common control step in prop payouts.

- Processing and release depends on the plan and queue. Many traders describe bi-weekly payouts as the default on some setups, with faster timing tied to plan type or add-ons.

Set your expectations early: timing changes with plan rules, support load, and how clean your account looks on review. The fastest payouts tend to happen when your behavior is boring and consistent.

Two habits reduce stress if anything gets questioned:

- Keep records: save screenshots of your dashboard stats, the payout request confirmation, and export your trade history (weekly is a good rhythm).

- Keep messages polite and simple: support is more likely to help quickly when you stick to facts and avoid emotional back-and-forth.

Consistency rules, the hidden reason some payouts get denied

A lot of traders focus on drawdown rules and forget the “shape” of their profits. Many prop programs use a consistency metric to discourage one lucky day carrying the whole account. In GFunded discussions, you’ll often hear traders mention a 20% consistency-style rule, meaning a single day’s profit can’t make up too much of your total profit.

Here’s a simple example so it’s easy to spot:

- You finish a payout period up $5,000 total.

- If a consistency rule caps one day at 20% of total profit, then one day shouldn’t contribute more than $1,000.

- If you made $2,500 in one big session and only $2,500 across all other days, that one day is 50% of the total. That can trigger a denial, a delay, or a “trade more days to balance it” requirement, depending on the program.

This is why reviews sometimes change after a first withdrawal. A trader can pass the evaluation with a big day, then run into payout friction because the firm wants smoother results.

How to avoid consistency issues without overthinking it:

- Keep position size steady: big size jumps are the fastest way to create an “all profit came from one day” problem.

- After a big win, reduce risk for a few sessions. Let smaller wins fill in the equity curve.

- Don’t try to finish the month in one trade. Even if it works, it can look like gambling from the outside.

Consistency rules reward traders who can repeat the same behavior week after week. If your strategy needs occasional giant days, you’ll want to know that before you plan your first withdrawal.

Does a payout change your drawdown buffer, what to double check first

A payout can also change how safe your account feels. Some prop firms adjust (or “rebase”) risk limits after withdrawals, based on your post-payout balance or equity. When that happens, your breathing room can shrink, even if you’re still up overall.

A common scenario looks like this:

- You build profit, request a withdrawal, and your balance drops after the payout.

- If the system ties max-loss math to the new balance, your buffer can feel tighter than it did before the withdrawal.

- The result is confusing: you did well, got paid, then a normal pullback suddenly looks like a rule breach risk.

That’s why you should read payout terms and drawdown terms as one combined rule. Don’t treat them like separate topics.

Before you request, double check:

- Does max loss trail or stay static, and is it measured on equity or balance?

- Does a withdrawal change the reference point for drawdown?

- Is there a minimum balance or buffer you must keep to stay payout-eligible?

Also, take proof snapshots so you’re not relying on memory later. Grab screenshots of key dashboard metrics before and after the request (equity, balance, drawdown numbers), plus your payout confirmation. If something looks off after the payout, you’ll have clean timestamps and data to point to.

How to read GFunded prop firm reviews like a detective, not a fan

Most review pages mix real experiences with missing context. That’s why a score (often around 4.0/5 with lots of reviews) doesn’t settle the question. The better move is to read reviews like evidence: match each claim to a plan type, a rule set, and a timeline, then look for patterns across months, not one screenshot.

A simple framework that works: Claim, Context, Proof, Pattern. What happened? On which plan and platform? What proof supports it? Do multiple people report the same issue under the same rule?

Green flags in reviews, the details that usually mean the story is real

The most believable GFunded prop firm reviews read like a short incident report, not a hype post. They name what matters: Instant Funding vs evaluation, the platform used (often TradeLocker, DXTrade, or Match Trader), the instrument traded (EURUSD, NAS100, gold), and the exact rule that mattered (daily loss, max loss, consistency, news window).

Look for proof that’s hard to fake and easy to verify:

- Screenshots of dashboard metrics that show equity, balance, and drawdown on the same screen (bonus points if there are timestamps or multiple days shown).

- Trade history exports (CSV or platform export) that match the story, including entry times and lot sizes.

- Multiple payouts across different months, not just a first withdrawal win. Repeat payouts are the closest thing to a “track record” in review form.

- Clear notes about the payout path, like “requested Monday, approved Wednesday,” plus the method used.

The calm, boring details around support are also a green flag. A solid review might say support asked for normal KYC items (ID, proof of address, or a quick identity check), or that a payout review asked for a trade explanation and they provided it. When someone describes what was requested, what they sent, and how long it took, it usually means the story has shape and friction, which is how real payouts work.

Red flags in reviews, what often points to a rule miss or missing context

Many “they stole my profit” reviews fall apart when you ask one question: which rule was in play? If the review won’t name the plan type, the drawdown type, or even the month, you’re reading an opinion, not a report.

Common red flags to treat as missing context:

- No plan type mentioned (Instant Funding and evaluations can have different news rules, payout timing, and drawdown mechanics).

- Complaints that ignore trailing vs static drawdown, or don’t say if limits are based on equity or balance.

- A payout denial story that never shares the rule citation support referenced.

- Vague claims like “got flagged for no reason,” with no dates, no screenshots, and no trade log.

- Sudden all-in trading right before payout time, then shock that the account got reviewed. Firms often scrutinize size spikes, strategy changes, and behavior that looks like a last-minute push.

When you see a red-flag review, don’t argue with it. Translate it into detective questions: What was the timeline? Which rule triggered? Was it equity or balance? Was drawdown trailing? Did lot size jump near the payout request?

A quick pre purchase checklist that prevents most “surprise” breaches

Most bad outcomes are preventable if you treat the purchase like a contract and your first week like a test drive.

- Read the full rules, not the highlights (daily loss, max loss, news rules, restricted tactics, payouts).

- Confirm drawdown type (trailing or static) and whether limits use equity or balance.

- Check minimum trading days and activity rules (inactivity can close accounts).

- Verify your platform for your exact plan, and the price feed or broker partner if it’s disclosed.

- Test spreads and execution on a trial, or trade small size first on your main instruments.

- Finish KYC early, before your first payout request.

- Keep weekly trade exports and dashboard screenshots (equity, balance, drawdown, and payout request confirmation).

Do this, and reviews get easier to read. You’ll spot which complaints are likely rule misses, and which point to real platform or payout friction.

Conclusion

GFunded prop firm reviews make a lot more sense when you read them through the rules first. Many plans get described around a 10% evaluation target, tight loss caps (often near a 4% daily limit and a 6% max loss), and no hard time limit, but the details decide everything. Equity vs balance tracking, trailing vs static drawdown, inactivity rules, and consistency limits (you’ll often see a 20% consistency-style metric) explain why one trader gets paid and another gets breached.

GFunded can work well for disciplined traders who keep risk small, size positions calmly, and keep their trading behavior clean. It can also feel unforgiving if you oversize, chase the target, or “switch modes” right before a payout request. That’s also where payout reviews, KYC checks, and any internal profit holding steps can add friction, even when the trades look fine on a chart.

Treat the fee like money you might lose, pick a plan size that won’t hurt if you fail, and document everything (dashboard stats, trade exports, payout confirmations). Confirm country eligibility in the dashboard and current terms first, because access can be restricted in some regions.

The best next step is simple, read the full terms, then compare 2 to 3 firms using the same rule-based checklist.