Admiral Markets Review Is It Legit and Worth Using?

What is Admiral Markets?

Founded in 2001, Admiral Markets (now also branded as Admirals) is a long-running Forex and CFD broker. The company operates internationally, with headquarters in the UK and offices in places like Cyprus, Estonia, and Australia. Ahead of its 20-year mark, the broker refreshed its branding to Admirals. The broker stated the name and look changed, but its core service stayed the same.

Admiral Markets uses STP and NDD execution, with details depending on the entity and where your account is registered.

From our research, the broker offers low, competitive spreads, solid liquidity, and no major limits on trading styles. That makes it a fit for many strategies, from manual trading to automation.

Admiral Markets Pros and Cons

Admiral Markets has a strong reputation and solid regulatory coverage. The signup process is simple and fully online. In many cases, spreads are among the lower options in the market. You can trade on MT4 or MT5, and the broker supports common strategies like scalping, Expert Advisors (EAs), and copy trading. Education and market research tools are also a big plus, and support is available 24/7.

There are a few trade-offs. Conditions can change based on the entity, and some deposit methods may include extra fees in certain regions. Some user feedback online mentions pricing details or platform fit, so it’s smart to confirm the terms for your country and account type before funding.

Advantages

- Long operating history and solid track record

- Strong regulation and recognized licenses

- No major limits on strategies

- MT4 and MT5 available, with enhanced add-ons

- 24/7 customer support

- Works for beginners and experienced traders

- Strong education, plus free Dow Jones analysis

Disadvantages

- Some deposit methods can add extra fees

- Terms can vary by entity and location

Admiral Markets Features (Quick Snapshot)

Admiral Markets Features in 10 Points

- Regulation: ASIC, FCA, CySEC, FSCA, JSC, CMA, EFSA

- Account types: Trade.MT5, Invest.MT5, Zero.MT5, Trade.MT4, Zero.MT4

- Platforms: MT4, MT5, Admirals Platform, Admirals Mobile App

- Tradable markets: Forex, Stocks, Commodities, Indices, ETFs, Bonds

- Minimum deposit: $1

- Average EUR/USD spread: 0.6 pips

- Demo account: Available

- Base currencies: USD, EUR, JOD, AED, GBP

- Education: Trading Academy

- Customer support: 24/7

Who Admiral Markets Is a Good Fit For

Admiral Markets works for many trading styles and experience levels, including:

- Beginners who want strong learning support

- Experienced traders who need broad market access

- Scalpers

- MT4 and MT5 users

- EA and automated strategy users

- Traders focused on low spreads

- Copy trading users

- Traders who want a wide instrument list

Admiral Markets Summary

Admiral Markets is a well-regulated broker with access to deep liquidity and quick execution. You can start with a low deposit, and pricing is competitive across many instruments. The broker focuses heavily on MetaTrader, offering both MT4 and MT5 accounts.

Professional Insights

With over two decades in the market and a large global user base, Admiral Markets has built a strong name. It’s a strong match for beginners due to broad availability, low entry points, and a deep set of educational tools. At the same time, more advanced traders can use MT4 and MT5 tools, automation, and strategy features.

The product list is diverse, and the broker also offers an investment account that supports real stocks and ETFs, which is less common among Forex-focused brokers. One thing to keep in mind is that conditions can differ by entity, so it’s worth checking the exact terms for your region before opening and funding an account.

Consider Admiral Markets if you want

- A broker with strict regulatory oversight

- Low starting deposits

- Low spreads and clear pricing tables

- MT4 or MT5 trading

- Support for advanced strategies and EAs

- Strong education and research tools

- A wide selection of instruments

Skip Admiral Markets if you need

- Fixed spreads

- Very high leverage everywhere

- Islamic accounts across all account types (availability is limited)

- Platforms like cTrader or a full proprietary platform

Regulation and Security Measures

Admiral Markets Regulatory Overview

Admiral Markets (Admirals) holds licenses from several respected regulators, including the FCA (UK), CySEC (Cyprus), and ASIC (Australia). These licenses support the broker’s legitimacy and require ongoing oversight. Rules can differ by region, but the main goal stays the same, protect clients and keep operations transparent.

How Safe Is Trading With Admiral Markets?

The broker follows standard safety steps required by regulators, including:

- Client money segregation, client funds are held separately from company funds

- Extra insurance coverage up to 100,000 USD (as stated by the broker)

- FSCS membership for Admiral Markets UK Ltd, with coverage up to £50,000 under FCA client asset rules (CASS)

Track Record and Transparency

Admiral Markets has operated since 2001 and built a large client base over time. The broker’s multiple licenses support a stable service model. Reviews across different platforms are often positive, though some traders mention fees or platform preferences. It’s best to confirm costs, account terms, and platform fit before committing funds.

Account Types and Benefits

Available Account Types

Admiral Markets offers several accounts tied to MetaTrader platforms.

MT5 accounts:

- Trade.MT5

- Invest.MT5

- Zero.MT5

MT4 accounts:

- Trade.MT4

- Zero.MT4

Your best choice depends on your platform preference, minimum deposit, pricing (spread and commission), and the instruments you want to trade.

Keep in mind, Islamic account access is limited to Trade.MT5. Leverage depends on location and instrument, and can vary by entity.

Trade.MT5

Trade.MT5 starts with a $25 minimum deposit and supports multiple markets. Spreads start from 0.5 pips. A $0.02 per share commission applies only to Single Share and ETF CFDs, with no commission on many other instruments.

This account supports Market Execution and allows common strategies such as hedging. Tools may include an economic calendar, Trading Central, and Dow Jones news and analysis.

Invest.MT5

Invest.MT5 starts from a $1 minimum deposit. It provides access to 4,500+ stocks and 400 ETFs (figures stated in the source text). It uses Exchange Execution, which can be useful for stocks and ETFs.

Spreads can start from 0 pips, with commissions from $0.02 per share (single-sided). You also get features like market depth and an economic calendar.

Zero.MT5

Zero.MT5 focuses on pricing for active traders. It offers access to 80+ currency pairs, plus metal CFDs, cash index CFDs, and energy CFDs. Spreads start from 0 pips, with commissions that vary by instrument (about $0.05 to $3.0, depending on the market).

It supports advanced tools like Expert Advisors and MetaQuotes signals.

Trade.MT4

Trade.MT4 also starts with a $25 deposit. The instrument list is smaller than MT5, but it’s often seen as a comfortable setup for newer traders who prefer MT4.

Spreads start from 0.5 pips. Share and ETF CFD commissions start at $0.02 per share, and many other instruments carry no added commission. EAs and advanced tools are supported.

Zero.MT4

Zero.MT4 shares many settings with Trade.MT4 (MT4 access, $25 minimum deposit, similar leverage rules). It offers a narrower product list, mostly currency pairs, metal CFDs, cash index CFDs, and energy CFDs.

Spreads can start from 0 pips, with commissions that vary by instrument (about $0.05 to $3.0). Base currencies include USD, EUR, JOD, and AED.

Regions Where Admiral Markets Is Restricted

Admiral Markets supports many countries. The broker lists Belgium as restricted on its site, along with other regions where local rules limit this type of service. Always confirm availability in your country before signing up.

Cost Structure and Fees

Admiral Markets Trading Fees

Pricing depends on the account type, the instrument, and the entity handling your account. Here are the main cost buckets.

Spreads

Admiral Markets offers floating spreads that can start from 0 pips. A typical EUR/USD spread is around 0.6 pips. On top of spreads, some instruments include commissions, especially shares and ETFs.

Commissions

Commissions vary by account and instrument.

- Trade.MT5: spreads from 0.5 pips, commission from $0.02 per share for Share and ETF CFDs, with no commission on many other markets

- Zero.MT5: spreads from 0 pips, commissions vary, for example Forex and metals from $1.8 to $3.0, cash indices from $0.05 to $3.0, and energies around $1 (as stated in the source text)

Because pricing varies, it’s smart to check the contract specs for your exact account and region.

Swap (Overnight) Fees

Swap fees apply to positions held overnight on Forex and CFDs. They can be positive or negative depending on the instrument and direction. Rates change, so you should review current swaps inside the platform before holding trades overnight.

Fee Competitiveness

Fees are transparent in the broker’s materials, but the mix of spreads and commissions can feel complex at first. Overall, the low spreads and reasonable commission levels can work well for cost-focused traders, especially those who understand how their account is priced.

Other Fees

- Inactivity fee: $10 per month after 24 months of no activity

- Conversion fees: apply when trading in a currency different from your account base currency, based on the exchange rate and entity rules

Trading Platforms and Tools

Admiral Markets focuses mainly on MetaTrader 4 and MetaTrader 5, including web and mobile options. The broker also offers the Admirals mobile app.

Web Platform (WebTrader)

Admiral Markets WebTrader lets you use MT4 or MT5 in a browser, with no install needed. It works on PC and Mac, and supports a wide set of instruments.

The broker reports an average execution time of 170 milliseconds, with no requotes. The web platform includes key charting tools and indicators from the desktop version.

MetaTrader 4 (Desktop)

MT4 is popular for its simple layout and strong support for automation. With Admiral Markets MT4, you get charting, alerts, news, and analysis tools. It also supports backtesting, trading signals, and a large set of technical indicators.

MetaTrader 5 (Desktop)

MT5 adds more built-in tools and markets. Admiral Markets MT5 supports trading robots, more timeframes, additional order types, and a larger set of indicators. It also supports copy trading and market depth data, plus MQL5 for custom tools and signals.

Admirals Mobile App

The Admirals app supports trading and account monitoring on mobile. It provides access to CFDs across forex, stocks, indices, commodities, and ETFs. It’s a practical option for checking positions and managing trades while away from a desktop.

Mobile apps can feel more limited than desktop platforms, especially for advanced chart setups, but they work well for daily monitoring and basic trading.

Trading Instruments

Admiral Markets lists 8,000+ instruments across several asset classes. You get access to 80+ currency pair CFDs, share CFDs, and global indices, plus more.

Available markets typically include:

- Forex

- Index CFDs

- Share CFDs

- Bond CFDs

- Commodity CFDs

- ETFs

Instrument access can depend on the account type and platform, so check your account specs before you commit.

Leverage at Admiral Markets

Leverage depends on your location and the entity that serves your account.

- Retail clients in Europe often see caps around 1:30 due to regulatory rules

- Australia also limits retail Forex leverage to 1:30

- International clients may access higher ratios depending on the instrument

- Some index products can go up to 1:500, depending on account type and jurisdiction

Deposit and Withdrawal Options

Deposit Methods

Funding options vary by region. Common methods include:

- Bank transfer

- Credit and debit cards

- Skrill

- Neteller

- PayPal (not available everywhere)

- Local payment methods

Minimum Deposit

- Invest.MT5: from $1

- Other accounts: usually $25

Withdrawals

Withdrawal requests can be submitted anytime, as long as you meet account and payment terms. The broker may send funds back to the original funding source and may ask for extra documents when needed.

- One withdrawal per month is free

- Additional withdrawals in the same month may cost $10

- Available withdrawal methods depend on your region

Customer Support and Responsiveness

Admiral Markets offers support through live chat, email, and phone. Replies are typically helpful and clear. There’s also an FAQ section for common questions.

Admiral Markets Contact Options

- Live chat: quick help through the website, with follow-up from support if needed

- Email:global@admiralmarkets.com (local emails may vary by country)

- Phone: +27 12 004 1882 (regional numbers may be available)

- Social media: active channels with updates and announcements

Research and Education

Research Tools

Admiral Markets offers research tools both inside MetaTrader and through its site, including:

- Economic calendar: track key events and filter by country and time zone

- Trading news: market updates tied to major financial events

- Analytics portal: news, technical analysis, sentiment, and calendar tools, with content from Dow Jones, Trading Central, and Acuity

- Fundamental analysis: reports and updates on major economic drivers and company-level factors

Education

The broker’s Trading Academy includes materials for different skill levels:

- Articles and tutorials on Forex and CFDs

- Free live webinars

- Zero to Hero (a 20-day learning series described in the source text)

- Risk management lessons

- A trader glossary for key terms

Admiral Markets can work well for beginners because the learning tools are easy to access, and account minimums are low.

Portfolio and Investment Opportunities

Admiral Markets is mainly known for CFDs, but it also offers traditional investing through Invest.MT5. This account provides access to 4,500+ stocks and 400 ETFs, allowing clients to buy real stocks and ETFs (based on the source text). Commissions start from $0.02 per share.

The broker also supports copy trading, letting users follow other traders through leaderboards. Before using copy trading, clients may need to answer suitability questions tied to risk tolerance.

Account Opening

Opening a Demo Account

- Click Try Demo on the broker’s site

- Complete the registration form

- Confirm your email

- Choose demo settings

- Download MT4 or MT5 (or use web)

- Start practicing

Opening a Live Account

- Go to Getting Started

- Enter your personal details

- Upload required documents

- Wait for approval

- Go to Accounts, choose Live

- Click Add account, then pick trading (CFDs) or investment (stocks and ETFs)

- Choose base currency and set a password

- Fund your account and start trading

Additional Tools and Features

Admiral Markets includes extra tools that can improve the trading setup, depending on your needs.

- StereoTrader: a MetaTrader trading panel with advanced order options and faster trade management tools

- VPS service: supports running MT4 and MT5 24/7, including EAs and indicators, with support access

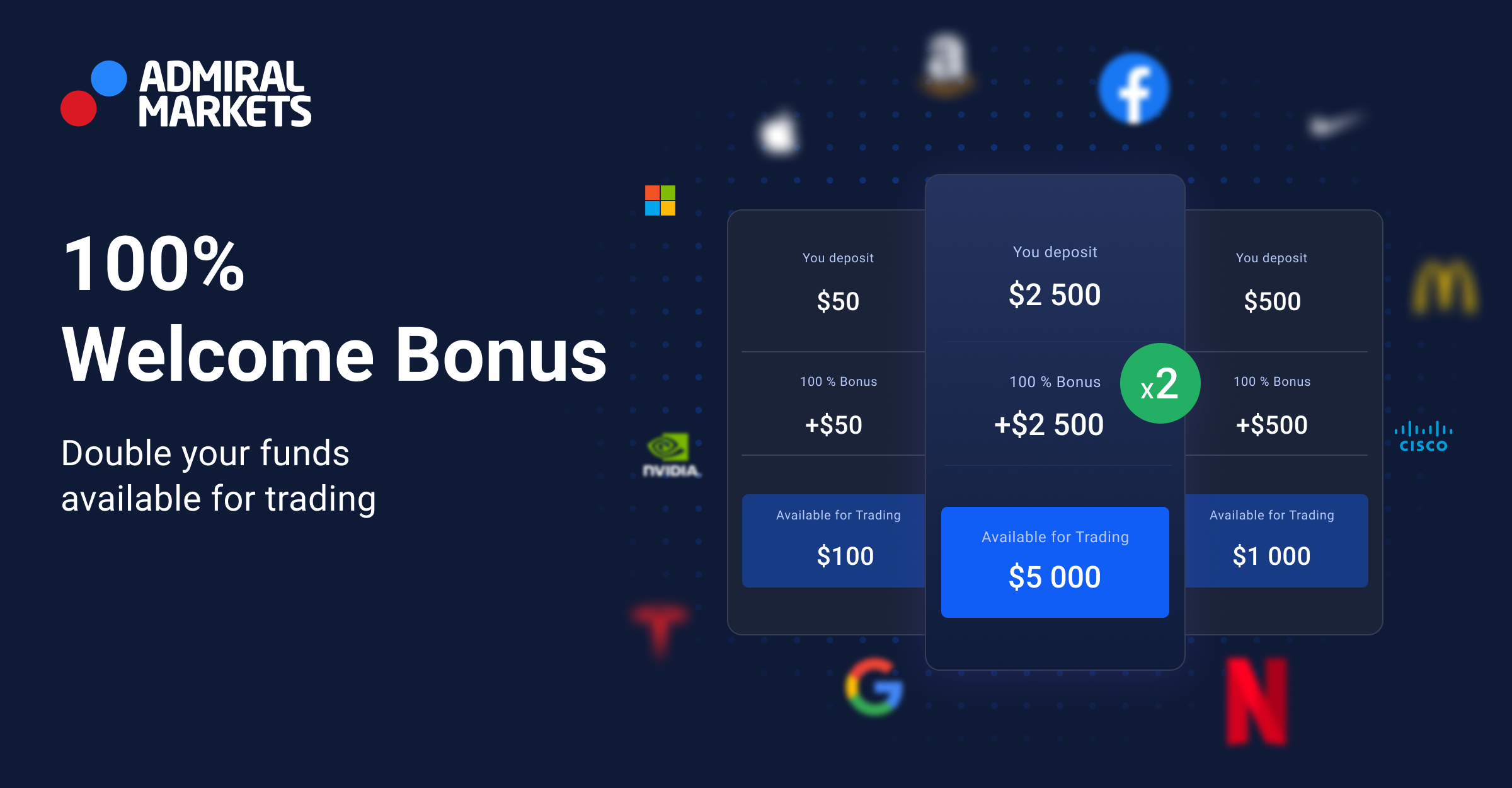

- Welcome Bonus: described as credited after opening a live account and available for withdrawal, with limits for internal transfers (availability may depend on region and rules)

- Parallels for Mac: supports running Windows apps like MT4 and MT5 on macOS

- Market Map: helps track price moves, trends, volatility, and potential trade ideas

Admiral Markets Compared to Other Brokers

Admiral Markets stands out for its regulation mix, low minimum deposit options ($1 for Invest.MT5, $25 for most other accounts), and a large list of instruments (8,000+). Many brokers offer fewer markets, so this variety helps with diversification.

On platforms, Admiral Markets focuses on MT4 and MT5. Some competitors offer more options like cTrader or proprietary platforms, so platform choice may matter if you want alternatives to MetaTrader.

Pricing is competitive, but the spread plus commission model can feel confusing for new traders. If you only want a spread-only setup, you may prefer to compare with brokers that focus on that structure.

Full Review Summary

Admiral Markets is a well-regulated broker with strong tools for both new and experienced traders. It offers quick execution, a broad set of instruments, and low entry requirements. MT4 and MT5 support is solid, and automated trading is available for those who want it.

The broker also adds value through research and education, including webinars, articles, and analytics from well-known providers. If you’re comfortable with MetaTrader and you don’t mind checking fee details by account and region, Admiral Markets can be a reliable choice for Forex, CFDs, and even longer-term investing through Invest.MT5.